What is the difference between an Accountant and an Accounting Assistant?

Both accountants and accounting assistants work in the field of finance. However, there are some critical differences between the two roles.

Accountants are typically responsible for analyzing financial data. They also prepare financial statements and provide strategic guidance to the management. Accountants often hold professional certifications such as Certified Public Accountant (CPA). They have a more in-depth understanding of accounting principles and tax laws.

On the other hand, accounting assistants focus more on the day-to-day financial tasks. These tasks include bookkeeping, data entry, and processing invoices. They assist accountants and ensure that financial records are accurate and current. While they may have a different level of expertise than accountants, accounting assistants play a critical role in maintaining the financial health of an organization.

What does an Accounting Assistant do?

Accounting assistants perform a wide range of tasks to support the finance department. Here are some of their day-to-day responsibilities:

- Bookkeeping: Accounting assistants are often responsible for maintaining accurate financial records. They record financial transactions, reconcile bank statements, and update financial spreadsheets.

- Data Entry: They enter financial data into accounting software or spreadsheets. This includes inputting invoices, receipts, and other financial documents.

- Invoicing: These professionals generate and send out invoices to clients or customers. They ensure that all invoices are accurate. They also include the necessary details, such as payment terms and due dates.

- Accounts Payable and Receivable: They assist in managing accounts payable and receivable processes. This involves processing vendor invoices, preparing payments, and tracking outstanding customer payments.

- Payroll: Accounting assistants might handle payroll. They figure out the salary of employees. They also ensure employees get their salary correctly and on time.

- Financial Reporting: They assist in preparing financial reports. These reports are balance sheets and income statements. They may also help with budgeting and forecasting activities.

- General Administrative Support: Lastly, they may provide general administrative support to the finance department. This can include answering phone calls, responding to emails, and organizing financial documents.

Job Outlook

The job outlook for accounting assistants is generally favorable. Companies keep depending on financial experts to handle their finances. Thus, the need for them is expected to stay about the same.

The Bureau of Labor Statistics predicts a 6% decline from 2022 to 2032 in jobs for bookkeeping, accounting, and auditing clerks. This includes accounting assistants. This decrease is because of technology doing some automated tasks. Despite this decline, there will still be 183,900 openings for bookkeeping, accounting, and auditing clerks projected each year, on average, over the decade. It is to support accountants and perform tasks that require human judgment and analysis.

It’s good to know that the demand for accounting assistants can vary by industry and location. Industries such as healthcare, finance, and professional services often demand more accounting professionals, including accounting assistants.

Final Thoughts

Accounting assistants play an essential role in maintaining the financial stability of organizations. They support accountants by ensuring accurate financial records. They also provide proper transaction recording and timely financial report preparation.

If you’re interested in pursuing a career as an accounting assistant, various vocational training programs are available. You can check out the CCI Training Center to help you gain the necessary skills and knowledge. CCI Training Center offers flexible program formats, including instructor-led online classes, to accommodate the needs of students. They also provide career services to assist students in job placement and offer financial aid options to make education more accessible.

To learn more, visit their website or contact the CCI Training Center directly. Start your journey towards a rewarding career in finance today!

Program Offered

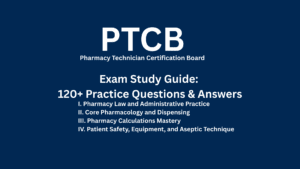

- Pharmacy Technician Training

- Online Medical Assistant

- Medical Billing and Coding Specialist Program

- Cloud Computing Technician Training

- Computer Network Technician

- Business and Accounting

- Radiology Technician Training

- Medical Assistant Program

- Computer Support Technician

- Cybersecurity Program

- Virtual Assistant Training

This article is written by

Share this article

Program Offered

- Pharmacy Technician Training

- Online Medical Assistant

- Medical Billing and Coding Specialist Program

- Cloud Computing Technician Training

- Computer Network Technician

- Business and Accounting

- Radiology Technician Training

- Medical Assistant Program

- Computer Support Technician

- Cybersecurity Program

- Virtual Assistant Training

This article is written by

Share this article

Related Articles

CCI Training Center Proudly Completes

41 Years in Career Training Services