Quick Summary

|

Thinking about a career that’s steady, respected, and recession-resistant? Becoming an accounting assistant could be your perfect entry into the finance world. It’s one of the few jobs where you don’t need a four-year degree to break in — just the right skills, attitude, and training.

Here’s the kicker: According to the U.S. Bureau of Labor Statistics, bookkeeping, accounting, and auditing clerks earned a median salary of $49,210 in May 2024, with nearly 174,900 openings projected every year thanks to retirements and workforce turnover.

That’s thousands of doors opening annually — and this blog will show you exactly how to walk through them.

What Does an Accounting Assistant Actually Do?

If you’re picturing dusty ledgers and calculators, think again. Today’s accounting assistants are software-savvy multitaskers who:

- Enter and reconcile financial data

- Prepare invoices, payroll, and expense reports

- Work with QuickBooks, Excel, and ERP tools

- Keep cash flowing by managing accounts receivable/payable

- Support accountants in audits and compliance

Translation? You’re the financial backbone of the team. Without you, bills don’t get paid, records don’t balance, and businesses fall apart.

Salary & Job Outlook

Curious about how much you can actually earn and what the future looks like for this role? Let’s break down the real numbers and hiring trends straight from U.S. labor data.

| Factor | Details (U.S.) |

| Median Annual Wage | $49,210 (BLS, May 2024) |

| Hourly Median Pay | ~$23.66 |

| Annual Openings | ~174,900 (turnover-driven) |

| Top Industry Pay | Local government: $51,530 |

| Projected Growth | -5% (2023–2032), but demand is steady due to retirements |

Reality Check: Don’t be scared by the negative growth number. Turnover means jobs keep opening — especially in small businesses where assistants are indispensable.

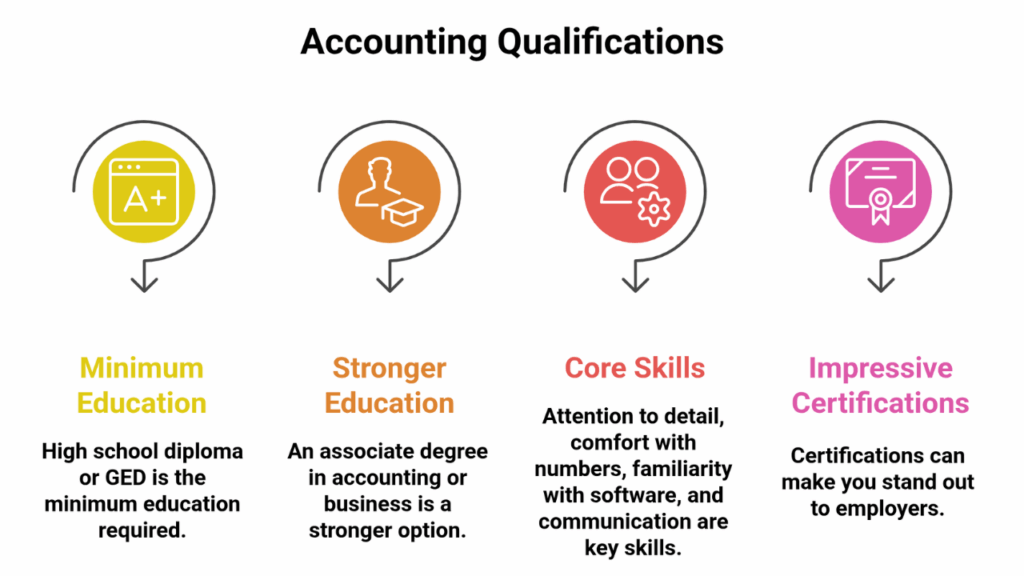

Education & Skills You’ll Need

Here’s what most employers want (and what gives you an edge):

Education

- Minimum: High school diploma or GED

- Stronger Option: Associate degree in accounting or business

Core Skills

- Attention to detail (errors cost $$$)

- Comfort with numbers & spreadsheets

- Familiarity with QuickBooks, Excel, Sage, or similar tools

- Communication & teamwork (finance is collaborative)

Certifications That Impress Employers

While a diploma gets your foot in the door, the right certifications can make you stand out instantly. Here are some credentials that employers love to see on a resume.

| Certification | Why It Helps |

| QuickBooks Certified User | Shows you can handle real-world software |

| Microsoft Excel Specialist | Essential for data analysis & reporting |

| Certified Bookkeeper (AIPB) | Adds credibility & opens higher-pay roles |

How to Gain Experience Fast (Even Without a Finance Job)

- Internships/Part-Time Roles → Local accounting firms, small businesses, or even campus offices.

- Volunteer Work → Nonprofits and community centers always need bookkeeping help.

- Simulation & Online Training → Practice real-world transactions in QuickBooks/Excel.

- Leverage Past Experience → Worked retail? You already know cash handling and record-keeping.

Tip: Create a small portfolio (sample invoices, Excel sheets, reconciliations) to show employers. It makes you stand out instantly.

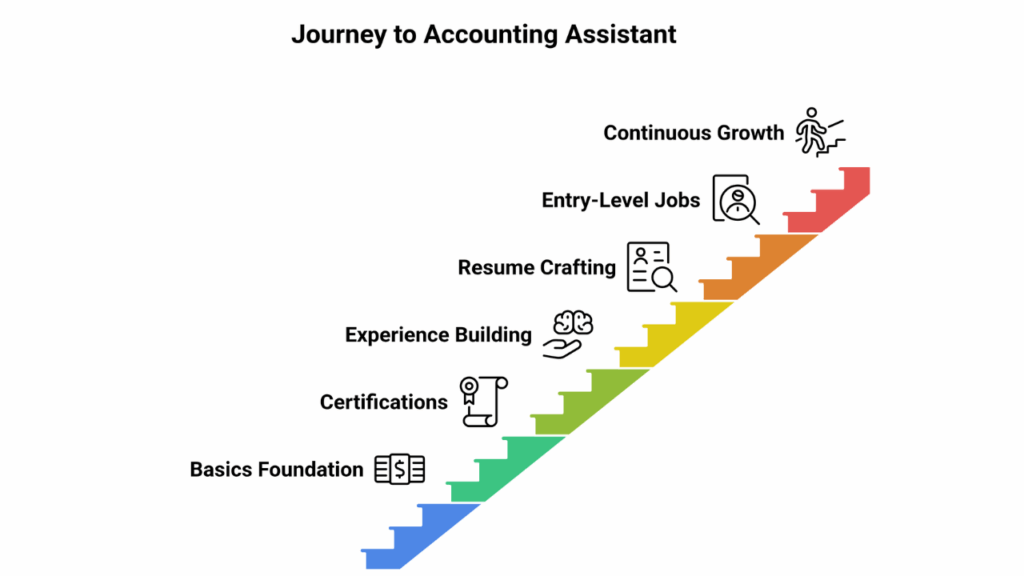

Step-by-Step Roadmap to Becoming an Accounting Assistant

Becoming an accounting assistant isn’t about years of school — it’s about smart moves. Here’s a streamlined roadmap to get you from beginner to hire-ready:

1. Get the Basics Right

A high school diploma or GED is your first ticket in. Pair it with short bookkeeping or accounting courses (online or local) to build a foundation.

2. Add Certifications That Shine

Boost your resume with quick, employer-trusted credentials like QuickBooks Certified User or Microsoft Excel Specialist. These can be completed in weeks, not years, and prove you can handle real-world tools.

3. Build Experience Creatively

Don’t wait for a job to start learning. Volunteer at nonprofits, intern at small businesses, or manage family accounts — anything that shows you can apply skills beyond theory.

4. Craft a Standout Resume

Highlight your software expertise, attention to detail, and any practical experience. Consider a mini-portfolio with sample invoices or reconciled sheets to wow hiring managers.

5. Target Entry-Level Openings

Small businesses, schools, medical offices, and local agencies often hire without strict degree requirements. These roles are perfect launchpads.

6. Keep Growing

Once you’re in, upskill continuously—from payroll to data analysis—to move toward higher-paying roles like bookkeeper, staff accountant, or even CPA.

Tip: Think of this roadmap as your fast-track career plan: clear, achievable, and built to get you job-ready in under a year.

Career Growth & Long-Term Paths

This role offers multiple growth trajectories, especially when you continue learning and expanding your skill set:

- Advance into full bookkeeping or accounting roles by strengthening foundational knowledge through resources like the Business & Accounting Training Program.

- Specialize in areas such as payroll or tax preparation with hands-on courses that emphasize QuickBooks and accounting software.

- Transition into accounting manager or audit support positions, where broader skills in business office administration can prepare you for leadership responsibilities.

- Progress toward advanced roles such as CPA, Controller, or Financial Analyst often starts with strong entry-level training in business and accounting.

How Much Time Does It Take to Become One?

Another common question: “How long will this take me?”

| HS Diploma + Short Online Course | 3–6 months |

| Associate Degree + Certifications | 18–24 months |

| Career Changer w/ Online Training | 6–12 months |

So yes — you could realistically be job-ready in under a year.

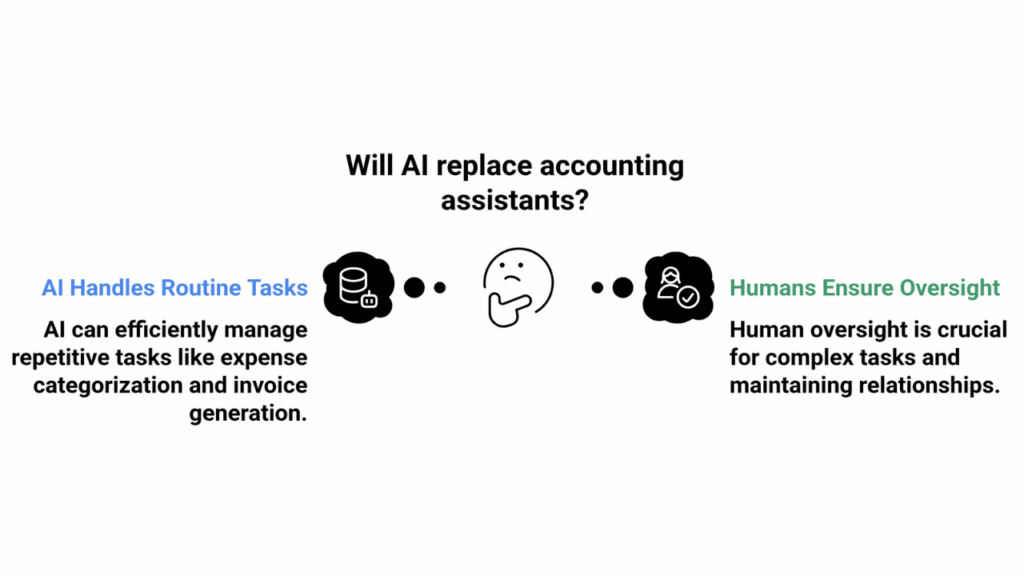

Will AI Replace Accounting Assistants?

The short answer: no, but the role is evolving fast.

Automation and AI are already handling repetitive, rule-based tasks such as:

- Auto-categorizing expenses in accounting software

- Generating recurring invoices

- Reconciling simple bank transactions

But here’s the truth: companies still need human oversight. Why? Because businesses can’t risk compliance errors, missed context, or broken relationships with vendors.

Here’s a side-by-side look:

| Tasks AI Can Handle Easily | Tasks That Still Need Humans |

| Categorizing routine expenses | Spotting unusual/complex errors |

| Sending recurring invoices | Managing vendor/client relations |

| Reconciling straightforward transactions | Applying judgment on financial exceptions |

| Auto-generating standard reports | Ensuring compliance with tax & labor laws |

Takeaway: Instead of fearing AI, think of it as your career accelerator. Assistants who know how to leverage AI and modern accounting software become:

- Faster at daily tasks

- More accurate with reporting

- More valuable as employers seek tech-savvy finance pros

The future accounting assistant isn’t just a “data enterer” — they’re a finance-tech hybrid, combining human judgment with digital efficiency.

Next Steps

So, where do you go from here? Think of this as your action plan to launch a successful career as an accounting assistant:

Start with Skills, Not Just School

- Complete at least one recognized certification (QuickBooks, Excel, Bookkeeping).

- Practice using free or trial versions of accounting software to build confidence.

Build a Small Portfolio

- Create mock invoices, expense sheets, and payroll entries.

- Show employers you can do the job before they hire you.

Target the Right Employers First

- Small businesses, nonprofits, and local offices often hire entry-level assistants without requiring degrees.

- These roles give you immediate, practical experience.

Keep Growing Once Hired

- Ask to take on tasks beyond data entry — payroll support, tax prep, or audit help.

- The broader your exposure, the faster your career accelerates.

Stay Future-Proof

- Follow trends in accounting automation and AI.

- Continuously upskill with online courses in data analysis, financial reporting, or ERP systems.

Remember: Accounting assistant jobs aren’t just a paycheck — they’re a launchpad. Every skill you learn here sets you up for bookkeeping, staff accounting, or management roles down the line.

Conclusion

Becoming an accounting assistant is a practical, high-value career step. It doesn’t demand years in school — just focused training, a little hustle, and the willingness to learn. With steady pay, stable demand, and clear growth paths, this role is one of the smartest entry points into the finance world.

Ready to take charge of your future?

[Enroll in Our Accounting & Business Program Today!]

Program Offered

- Pharmacy Technician Training

- Online Medical Assistant

- Medical Billing and Coding Specialist Program

- Cloud Computing Technician Training

- Computer Network Technician

- Business and Accounting

- Radiology Technician Training

- Medical Assistant Program

- Computer Support Technician

- Cybersecurity Program

- Virtual Assistant Training

This article is written by

Share this article

Program Offered

- Pharmacy Technician Training

- Online Medical Assistant

- Medical Billing and Coding Specialist Program

- Cloud Computing Technician Training

- Computer Network Technician

- Business and Accounting

- Radiology Technician Training

- Medical Assistant Program

- Computer Support Technician

- Cybersecurity Program

- Virtual Assistant Training

This article is written by

Share this article

Frequently Asked Questions FAQ's

Is an accounting assistant a stressful job?

Not usually. Deadlines can get busy (tax season), but it’s manageable compared to high-pressure finance jobs.

Can I work as an accounting assistant without a degree?

Yes — many start with just a high school diploma and certifications.

What’s the difference between an accounting assistant and a bookkeeper?

Bookkeepers record daily transactions. Accounting assistants do that plus support payroll, reporting, and admin tasks.

How can I stand out when applying?

Show software skills (QuickBooks, Excel), have certifications, and bring a small project portfolio to interviews.

What industries hire accounting assistants?

Almost every sector: healthcare, retail, education, construction, and especially small businesses.

What’s the fastest way to get hired?

Complete a QuickBooks/Excel certification, volunteer with a nonprofit, and apply for entry-level openings at local businesses.

Related Articles