What is the difference between business and accounting?

On the accounting side, you’ll develop skills in business finance and financial document preparation.

Basically, business covers more general business basics, so you leave with basic knowledge on how an organization is set up and how it operates. Accounting is more specialized because it covers financial topics and prepares you to take on financial responsibilities in your new job role.

Even for positions that don’t require specific financial skills, the Business and Accounting program provides you with an understanding of business financial principles, which makes you a more valuable asset to any organization, in any role.

What skills are learned in the business and accounting program?

Every successful company, no matter what industry, needs people who understand basic business and financials kills. Profitability depends on trusted employees with knowledge about – and commitment to – efficient business operations. CCI’s business and accounting program offer classes in:

- Microsoft Office

- Business Communication

- Basic Accounting

- Business Practice I

- Business Practice II

- QuickBooks

- Payroll Administration

- Practicum

- Career Development

Upon completion of the program, you will find that your job prospects have improved, and you have gained confidence in the added value you bring to your current position. You will have developed practical skills in:

- Business Basics

- Business Functions/Components

- Ethics in Business

- Financial Document Preparation

- Customer Service

- Workplace Communications

- Branch, Retail, and Department Management

- Principles for Business Success

Is this program useful for small business owners, or those who want to start their own business?

In a word – YES! The skills learned in the business and accounting program are very valuable to anyone running a small business or thinking of doing so, whether it is for a brick-and-mortar business, starting an online shop, or becoming a freelancer or consultant, the skills learned in the program teach you how to run a business successfully and profitably.

What types of jobs do graduates of the program apply for?

Successful completion of the business and accounting program at CCI broadens your opportunities for personal and professional growth. With an understanding of what it takes to be successful in business you can:

- learn the skills to start your own business, or how to run your current business more efficiently and profitably

- achieve advancementВ in your current career

- find meaningful work in an office or business environment

- develop marketable skills that nearly every company needs

Many of our students have been working in a job with little or no opportunity for advancement or are in a job with hours and pay that no longer suits their lifestyle and/or career goals. By gaining an understanding of business skills and principles, they have more control of their career path and trajectory.

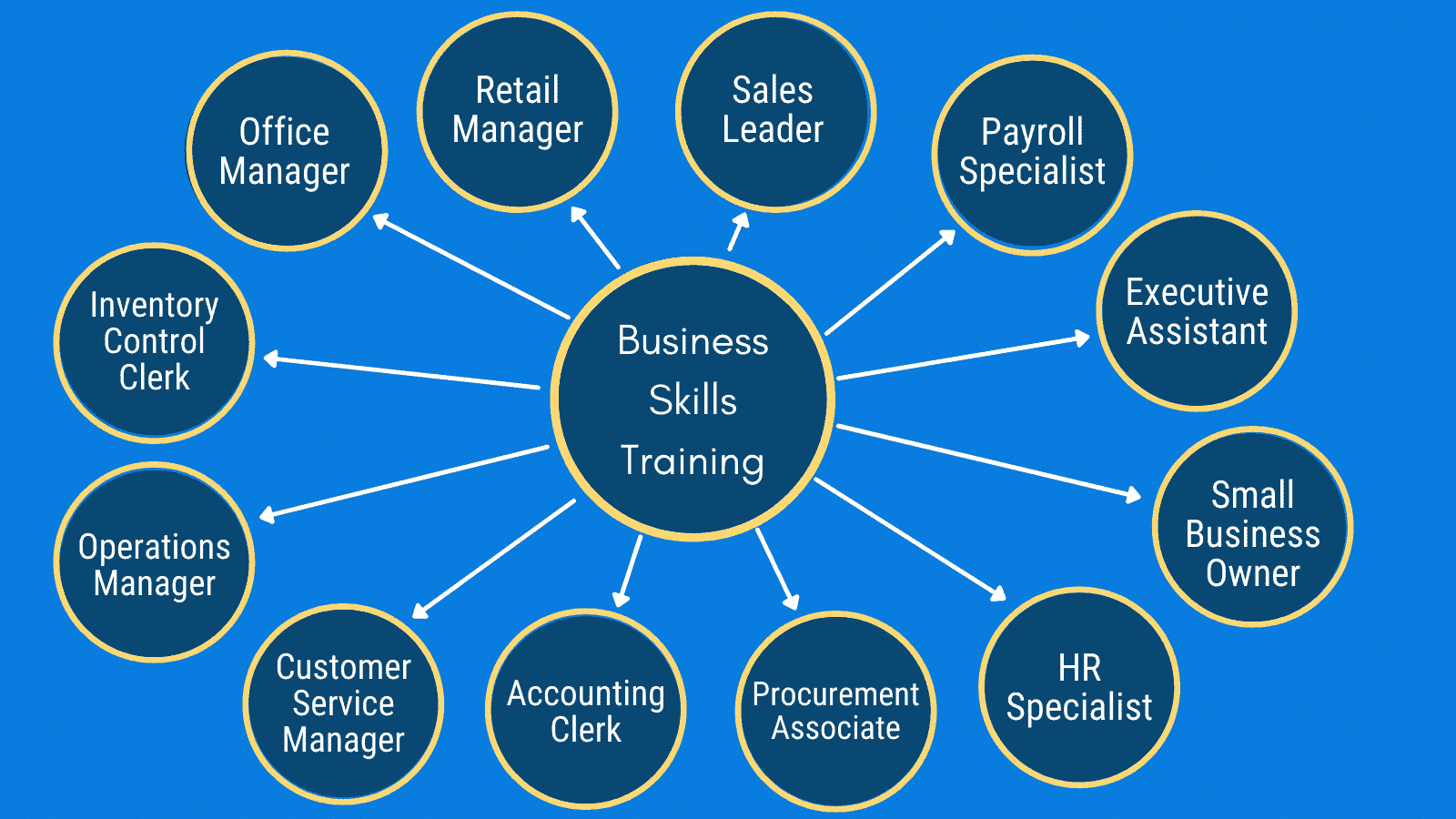

Some of the positions open to graduates of the program include:

How is accounting used in business?

What are the different types of business accounting?

There are three main types of business accounting you might encounter during your career: cost, managerial, and finance.

Cost accounting is when a company determines how much it costs to produce its products and/or services.

In managerial accounting, you’ll prepare financial documents for investors and management so that they can make appropriate business decisions.

Finally, in finance accounting, you’ll create financial statements for potential investors and other companies who’ve expressed interest in your organization.

There are other types of business accounting approaches you might encounter but these are the main ones you’ll find in almost every company.

What does accounting mean in business?

According to Xero’s website, business accounting is the systematic recording, analyzing, interpreting, and presenting financial information.

Accounting can be done by one person in a small business or by multiple groups in a bigger organization. Accountants help businesses, small and big, keep track of their financial spending. Without them, companies wouldn’t know if they are making the right financial moves or making a profit.

How do you learn small business accounting?

There are several ways to learn small business accounting such as online, in-person, or both. In addition, there are different ways to get certified in accounting like certificates, online programs, or traditional college degrees. CCI offers an accelerated Business and Accounting program that students can complete in as little as 28 weeks.

What is the best program for smallВ business accounting?

CCI teaches QuickBooks in its Business and Accounting program. Many businesses use this software to keep track of their expenditures and earnings. And, if you choose to learn with CCI, you’ll receive a QuickBooks certificate as part of the program.

Recommended for you

-

Business and Accounting

CCI Training Center’s Business & Accounting program is 100% online, making it ideal for those with additional professional and personal responsibilities.

How do you learn bookkeeping for small businesses?

Bookkeeping and accounting can sometimes be one and the same, they are very similar.

However, there is a subtle difference between accounting and bookkeeping. QuickBooks, which is part of the program curriculum, is one of the most popular small business accounting and bookkeeping software on the market. It helps organizations manage income and expenses, it can be used to invoice customers, pay bills and generate reports. An article on their website does a good job of explaining the differences between bookkeeping and accounting.