Importance of Accounting

Accounting is essential for businesses of all sizes, from small startups to multinational corporations. Here are some key reasons why accounting is important in a business:

- Financial Management: Accounting helps businesses manage their financial resources effectively by providing accurate and timely information about income, expenses, assets, and liabilities. This information enables business owners and managers to make informed decisions regarding resource allocation, cost control, and investment opportunities.

- Compliance with Regulations: Accounting ensures that businesses comply with legal and regulatory requirements. It helps in preparing financial statements, tax returns, and other reports that are required by government agencies, investors, and stakeholders. Proper accounting also helps businesses avoid penalties and legal issues associated with non-compliance.

- Decision Making: Accounting provides crucial information for decision making. It helps businesses evaluate the financial viability of projects, assess business performance, and identify areas of improvement. By analyzing financial statements and reports, businesses can make informed decisions about pricing, expansion, cost-cutting measures, and investment strategies.

- Investor Confidence: Accurate and transparent accounting practices inspire confidence among investors and stakeholders. When businesses maintain proper accounting records and provide reliable financial information, investors are more likely to invest in the company and support its growth. Good accounting practices also enhance the credibility of financial statements and reports, which is essential for attracting potential investors and securing loans from financial institutions.

- Performance Evaluation: Accounting enables businesses to evaluate their financial performance over time. By comparing financial statements from different periods, businesses can identify trends, assess profitability, and measure the effectiveness of their financial strategies. This information is invaluable for setting performance targets, monitoring progress, and making necessary adjustments to achieve business goals.

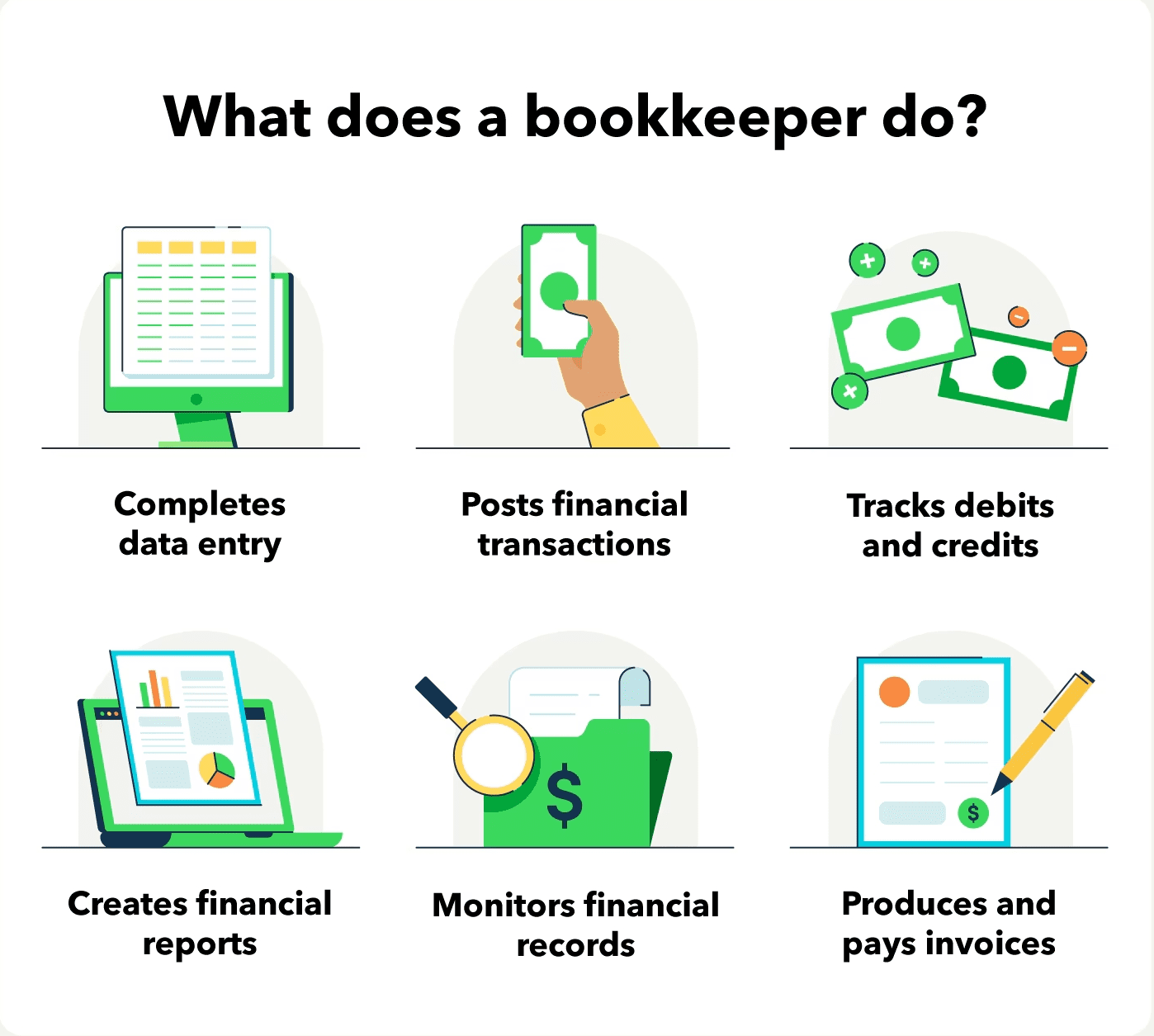

What is an accountant responsible for?

Accountants are financial professionals who are responsible for a wide range of tasks within a business. Here are some of the key responsibilities of an accountant:

Recording Financial Transactions

Accountants record and classify financial transactions such as sales, purchases, expenses, and payments. They ensure that all transactions are accurately recorded in the accounting system, following established accounting principles and standards.

Preparing Financial Statements

Accountants prepare financial statements, including balance sheets, income statements, and cash flow statements. These statements provide an overview of the financial position, performance, and cash flow of a business, enabling stakeholders to evaluate its financial health.

Managing Accounts Payable and Receivable

Accountants manage accounts payable and accounts receivable. They ensure that invoices are processed and paid on time, and that customers’ payments are received promptly. By managing these processes effectively, accountants help maintain positive relationships with suppliers and customers.

Budgeting and Forecasting

Accountants play a crucial role in budgeting and forecasting activities. They analyze historical financial data, market trends, and business goals to create realistic budgets and financial forecasts. These tools help businesses plan for future expenses, allocate resources effectively, and evaluate performance against targets.

Tax Planning and Compliance

Accountants assist businesses in tax planning and compliance. They ensure that businesses meet their tax obligations and take advantage of available tax incentives. Accountants also prepare and submit tax returns, keeping businesses in compliance with applicable tax laws and regulations.

Internal Controls and Auditing

Accountants help establish and maintain internal controls to safeguard assets, prevent fraud, and ensure accurate financial reporting. They may conduct internal audits to assess the effectiveness of internal controls and identify areas of improvement. Accountants also work closely with external auditors during financial audits to ensure compliance with auditing standards and regulations.

Financial Analysis and Reporting

Accountants analyze financial data and prepare financial reports to provide insights into business performance. They identify trends, variances, and key financial indicators to support decision making and strategic planning. Accountants also prepare management reports, financial forecasts, and other specialized reports as required by management.

Recommended for you

-

Business and Accounting

CCI Training Center’s Business & Accounting program is 100% online, making it ideal for those with additional professional and personal responsibilities.

Job outlook for accountants

The field of accounting offers promising career opportunities for individuals with the right skills and qualifications. Here are some key factors to consider regarding the job outlook for accountants:

- Demand for Accountants: The demand for accountants is expected to grow in the coming years. Businesses of all sizes require skilled accountants to manage their finances, comply with regulations, and make informed decisions. Additionally, changes in tax laws, financial reporting standards, and globalization have increased the need for qualified accountants.

- Industry Diversity: Accountants can work in various industries, including finance, healthcare, government, non-profit organizations, and consulting firms. This diversity provides opportunities for specialization and career growth in specific sectors of interest.

- Advancement Opportunities: Accountants who demonstrate strong skills and expertise can advance their careers to higher positions such as financial managers, controllers, or even Chief Financial Officers (CFOs). Continuous professional development and obtaining certifications like Certified Public Accountant (CPA) can enhance career prospects and open doors to more senior roles.

- Salary Potential: Accountants can earn competitive salaries, with the potential for growth as they gain experience and advance in their careers. The salary range for accountants varies depending on factors such as location, industry, level of experience, and professional certifications.

- Technological Advancements: The accounting profession has been impacted by technological advancements, particularly in the areas of automation, cloud computing, and data analytics. Accountants who embrace these advancements and acquire relevant skills in data analysis and technology are likely to have a competitive edge in the job market.

- Global Opportunities: Accounting skills are in demand not only in local markets but also in the global business environment. With the increasing globalization of businesses, accountants with international experience and knowledge of global accounting standards can pursue exciting career opportunities worldwide.

Final Thoughts

Accounting plays a vital role in the success and growth of businesses. It provides valuable insights into financial performance, facilitates decision making, and ensures compliance with regulations. Accountants have diverse responsibilities, ranging from recording financial transactions to preparing financial statements and managing tax compliance. The job outlook for accountants is promising, with opportunities for career advancement and competitive salaries. By acquiring the necessary skills and qualifications, individuals can embark on a rewarding career in accounting.

To learn more about accounting, its role in business, and explore training options, consider reaching out to CCI Training Center. They offer programs that can help you gain the skills and knowledge needed to pursue a career in accounting. Financial aid options, accelerated program formats, flexibility, and instructor-led online classes are some of the features that make CCI Training Center a valuable resource for aspiring accountants. Additionally, their dedicated instructors and career services can provide the support needed to succeed in the field of accounting. Take the first step towards a rewarding career in accounting by contacting CCI Training Center today.